While we all understand the significance of term insurance, the decision of choosing

the coverage duration often leaves us in a dilemma—should it be until the age of 60

or extended to the age of 99? Most of us think about extending it till 99, as that

seems like sure shot win for us as we will most likely die before 99 and will surely get the coverage amount.

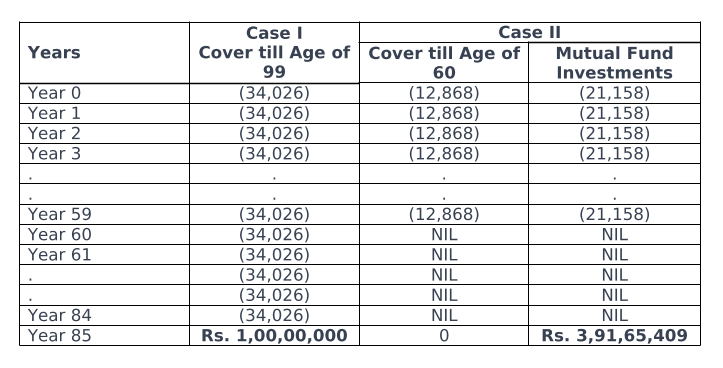

In this article, let’s analyse this with some number crunching. Let’s consider Rahul, a

30-year-old healthy man purchasing a 1 crore term insurance policy.

Case I: Rahul buys a term policy from a leading Life Insurance company covering up

to 99 years of age with an annual premium of Rs. 34,026.

Case II: Rahul buys a term policy from the same leading life insurance company

opting for a premium payment term until the age of 60, at an annual premium of Rs.

12,868. And he puts the balance savings i.e. Rs 21,158 (Rs 34,026 – Rs 12,868) in a

standard large-cap mutual fund earning him around 12% per annum on an average.

In case I, Rahul has to continuously pay the premium of Rs 34,026 until the age of 84, which includes post retirement year where you don’t want to pay for such products. And at the age of 85, as he dies, his nominee receives Rs 1 Cr.

In Case II, Rahul has to pay Rs 12,868 for insurance premium and invest balance Rs 21,158 in mutual funds only until the age of Rs 60. No cash outflows post-retirement, and this mutual fund investment gives his nominee a corpus of Rs 3.9 Cr at the age of 85, if or not Rahul dies.

Conclusion:

Opting for a term insurance premium payment term until the age of 60 proves to be a smart financial move. This decision not only saves the policyholder 21,000 rupees annually but also creates opportunities for strategic investments.

While insurance companies may suggest extending coverage until the age of 100, a closer look at the financial model reveals a significant disparity. The company aims to amass an extra 3.9 crores by charging an additional premium of 21,000, providing only a 1 crore insurance claim. This results in a profit exceeding 2.9 crores for them, funds that could have been our corpus if invested wisely.